If you are a Veteran seeking disability compensation, you should strongly consider filing for SSD benefits. Veterans can qualify for both VA and SSD benefits. However, VA and Social Security Disability benefits have different requirements.

Below, is an overview of the options available to you as a Veteran seeking Social Security Disability. If you have additional questions, a Veterans Disability Advocate can be your best resource.

Table of Contents

Date Last Insured:

For individuals who have not attained retirement age, and are seeking financial compensation through the Social Security Administration for a disability that prevents them from working, insured status is an important issue. To be eligible for Social Security Disability Insurance (SSDI) benefits, it is not enough that an individual paid into Social Security at some point in their lives. SSA requires that the individual paid recently and consistently leading up to the onset of their disability to receive financial compensation before reaching retirement age.

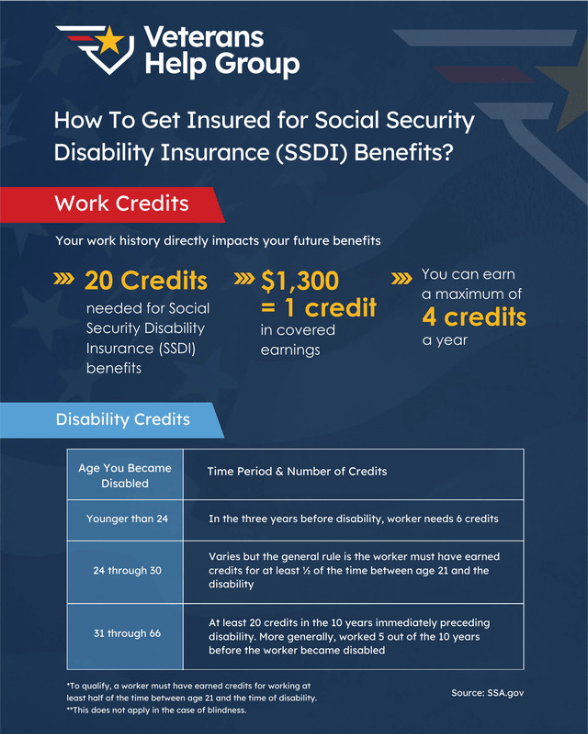

- 5 Out Of 10 Rule (20/40 rule): The simplest way to calculate whether an individual is currently insured for Social Security Disability is by looking at the last 10 years of their work history. If the individual worked and paid taxes for 5 out of the last 10 years, they should be insured for SSDI. The five years of work need not have been continuous during that 10 year period but has to amount to 5 years (Social Security breaks down each of the years into 4 quarters and a worker needs to have worked and paid taxes 20 out of 40 quarters to be insured).

- Expiration of Insured Status: Once an individual attains an insured status for SSDI benefits, the insured status will expire if the individual stops working and paying taxes. Generally, an insured status will expire five years after the last quarter paid into the system.

Example: Assume today’s date is December 1, 2023. An individual becomes disabled on December 1, 2023, due to medical issues. That individual’s work and tax history from 2013 through 2023 is the following: worked and paid taxes in 2014, 2015, 2016, 2017, and 2018 for the full years but stopped working in January 2019 to care for a family member and did not return to work.

– The individual’s SSDI insurance expiration date (date last insured or ‘DLI’) is likely to be December 31, 2023. Accordingly, the individual would be insured because the onset of their inability to work due to medical conditions occurred before the date last insured.

– If the individual’s medical issues arose in January 2024, that individual would likely not be insured for SSDI because the medical condition onset would have occurred after the date last insured.

- Remote Date Last Insured: Veterans have often been unable to work for many years due to medical conditions connected to the military service. Even if the veteran has not worked and paid taxes for 5 out of the last 10 years, they might still be able to get Social Security Disability. So long as the veteran worked and paid taxes for 5 out of the 10 years prior to when they stopped working due to medical issues, they still might be able to obtain SSDI.

Example: Assume a veteran is unable to work due to a combination of medical issues connected to his military service. The veteran is not at retirement age for SSA purposes and has been unable to work since 2010. That veteran stopped working because of medical issues back in 2010. Yet, between the years of 2000 and 2010, the veteran did work and pay taxes every year. The veteran did what many Americans do, they grinded it out for as long as they could. However, in 2010, they just could not work any longer. The veteran never applied for SSDI between 2010 and 2023 and now wants to know whether they can obtain SSDI. The answer is yes. Their date last insured would likely be December 31, 2015, and the onset of their inability to work would be prior to that date.

So long as the veteran was able to produce competent medical evidence showing medical conditions that would prevent them from being able to work between 2010 and 2015, they would be eligible for Social Security Disability.

- Res Judicata: The only issue with a remote DLI is the veteran only gets one chance to successfully navigate the process. If a veteran with a remote DLI is denied SSDI and they do not appeal or they exhaust their appeals, they will likely not be able to obtain Social Security Disability. SSA bars the re-litigation of similar claims’ issues under the doctrine of res judicata. Accordingly, if a veteran with a remote DLI is going to pursue SSDI, they must prosecute the claim fully or risk being barred from those benefits.

Dire Need Cases And TERI Cases For Social Security Disability:

Social Security Disability has three recognized claims that require expedited processing and adjudication of SSDI benefits. All these fall under the umbrella of ‘dire need’. (See HALLEX I-2-I-40 for more information)

- Terminal Illness (TERI) Case: If an individual applying for SSDI has a terminal illness they are entitled to expedited processing.

- Homeless Or Without Basic Needs: If an individual applying for SSDI can show they are homeless or without basic needs such as water or electricity, they can have their case flagged for expedited processing.

- 100% Disabled Veterans: A Veteran who is found to be totally disabled through the VA (TDIU or 100% combined rating) are entitled to expedited processing of their SSDI cases.

Medicare & TRICARE: How They Work Together

When you have Medicare Parts A and B, and you are TRICARE eligible, you automatically receive coverage from TRICARE For Life (TFL). There are no enrollment fees or forms. Medicare and TFL work together to minimize a member’s out-of-pocket expenses. (See TRICARE Handbook).

- TFL: TFL is Medicare-wraparound coverage for TRICARE beneficiaries who have Medicare Part A and Medicare Part B, regardless of age or where you live. This program provides comprehensive health coverage. A member has the freedom to seek care from any Medicare-participating or Medicare non-participating provider, or military hospital or clinic. Medicare participating providers file your claims with Medicare. After paying its portion, Medicare automatically forwards the claim to TRICARE for processing (unless you have other health insurance (OHO)). TRICARE pays after Medicare and OHI for TRICARE-covered health care services.

Under this arrangement:

- Medicare is your primary payer

- TRICARE pays second to Medicare or last if you have other health insurance

- TRICARE benefits include covering Medicare’s coinsurance and deductible for services covered by Medicare and TRICARE.

- When retired service members or eligible family members reach age 65 and are eligible for Medicare, they become eligible for TFL and are no longer eligible to enroll in other TRICARE plans.

We Can Help With Your Social Security Disability Claim:

At Veterans Help Group, we understand how stressful and complicated the VA disability process and related issues can be. Our VA disability advocates put years of experience to work for you and your family. Contact us now at 855-855-8992 to learn more about how we can help you!