Table Of Contents

An approximately $2 trillion Coronavirus/COVID-19 response bill was passed which is intended to help speed relief within the American economy. There are seven main groups which will see the widest reaching impacts: individuals, small businesses, big corporation, hospitals and public health, federal safety net, state and local governments, and education. Here is what each group can expect:

Individuals

This bill has multiple elements which aiming to help individuals. This includes direct cash for many, expanded unemployment benefits and new rules for filing taxes and retirement contributions.

· Cash Payments. Most individuals earning less than $75,000 can expect a one-time cash payment of $1,200. Married couples will each receive a check and families would get $500 per child. The checks phase down for people who make more than $75,000 and people making more than $99,000 and couples making more than $198,000 will not receive checks.

These cash payments are based on either your 2018 or 2019 tax filings. People who receive Social Security benefits but don’t file tax returns are still eligible. Their checks will be based on information provided by the Social Security Administration.

· Extra Unemployment Payments. The bill makes major changes to unemployment assistance, increasing the benefits and broadening who is eligible. States will continue to pay unemployment to people who qualify but this bill adds $600 per week from the federal government on top of whatever base amount a worker receives from the state. This payment will last for four month.

The legislation adds 13 weeks of unemployment insurance and people nearing the maximum number of weeks allowed by their state would get an extension.

· Gig Workers and Freelancers. Typically, self-employed people, freelancers, and contractors can’t apply for unemployment but this bill creates a temporary Pandemic Unemployment Assistance program through the end of this year to help people who lose work as a direct result of the public health emergency.

· Tax Returns. The filing deadline has been extended to July 15. The IRS also says that people who have filed can still expect to receive a refund.

· Student Loans. Employers can provide up to $5,250 in tax-free student loan repayment benefits. This means an employer can contribute to loan payments and workers wouldn’t have to include that money as income.

Small Businesses

The main components for small businesses are emergency grants and a forgivable loan program for companies with 500 or less employees.

· Emergency Grants. The bill provides $10 billion for grants of up to $10,000 to provide emergency funds for small businesses to cover operating costs.

· Forgivable Loans. There is $350 billion allocated for the Small Business Administration to provide loans of up to $10 million per business. Any portion of that loan can be used to maintain payroll, keep workers on the books or pay for rent, mortgage and existing debt could be forgiven, provided workers stay employed through the end of June.

Big Corporations

The bill set aside roughly $500 billion in loans and other money for big corporations. These companies will have to pay government back and will be subject to public disclosures.

Hospitals and Public Health

Lawmakers included funds to supplement community and private health systems to help meet the influx of new patients.

· Hospitals. There is $100 billion for hospitals responding to Coronavirus/COVID-19.

· Community Health Centers. The bill provides $1.32 billion in immediate additional funding for community centers that provide healthcare.

· Drug Access. There is $11 billion for diagnostics, treatments, and vaccines. The bill also includes $80 million for the FDA to prioritize and expedite approval of new drugs.

· Centers for Disease Control and Prevention. CDC programs and response efforts are getting $4.3 billion.

· Medicine and Supplies. The bill gives $16 billion to the Strategic National Stockpile to increase availability of equipment, including ventilators and masks.

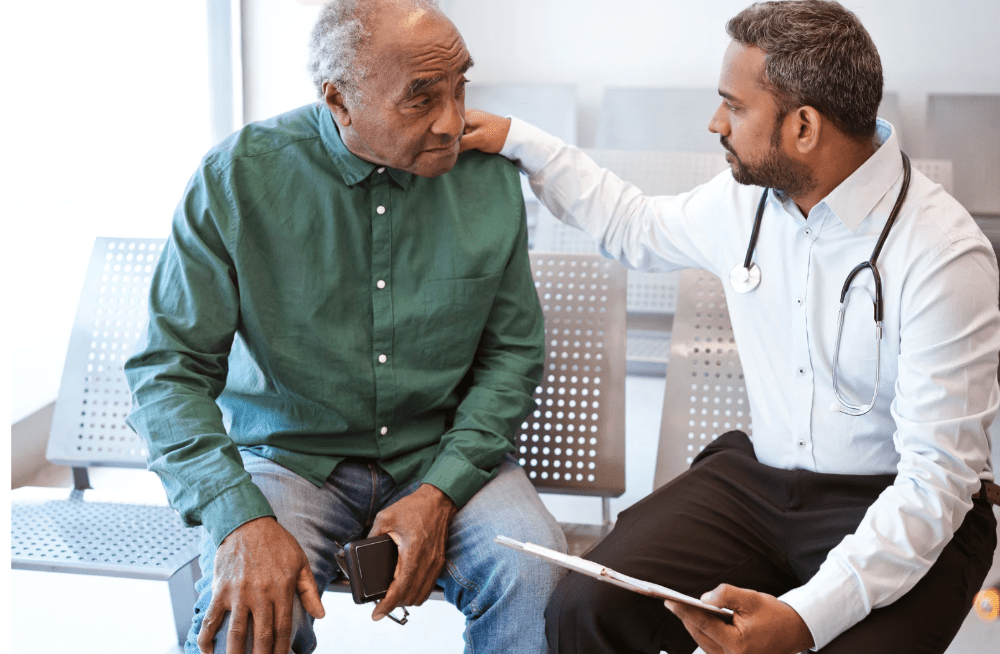

· Veterans Health Care. There is $20 billion set aside for veterans. $15.8 billion of the VA-marked will go to the Veterans Health Administration to cover treatment for veterans with Coronavirus/COVID-19 at VA hospitals, civilian urgent care clinics, and emergency rooms. $3.1 billion will go to building infrastructure for veterans care, including equipping and staffing for temporary hospitals, clinics, and mobile treatment centers and for remodeling existing facilities, including state run veteran homes to isolate and care for veterans with the highly contagious illness.

Federal Safety Net

· Child Nutrition. There is $8.8 billion to give schools more flexibility to provide meals for students.

· Food Stamps. $15.5 billion is going to the Supplemental Nutrition Assistance Program. The money will help cover the expected cost of new applications to the program as a result of the coronavirus.

· Food Banks. There is $450 million more for food banks and other community distribution programs.

State and Local Governments

The legislation designates $339.8 billion for programs that will go to state and local governments. It is divided to put $274 billion toward Coronavirus/COVID-19 response effort, including $150 billion in direct aid for those state and local governments running out of cash.

Education

The bill includes relief for college students and graduates with outstanding federal student debt.

· Temporary Student Loan Relief. All loan and interest payments would be deferred through Sept. 30 without penalty to the borrower for all federally owned student loans.

· Work-Study Funds. Allows schools to turn unused work-study funds into supplemental grants and continue paying work-study wages while schools are suspended.

Maximizing Dependency and Indemnity Compensation (DIC) Benefits

Maximizing Dependency and Indemnity Compensation (DIC) Benefits Written by Caroline Temple, Senior...

Veterans Help Group Serving Our Community

Veterans Help Group Serving Our Community By Bobbi Boudi, Director of Community Outreach & Amy...

How Much Back Pay Will You Receive?

What is VA Disability Back Pay? VA disability back pay is payment for benefits the veteran was...