Table Of Contents

Is My VA Disability Considered Income?

Disabled veterans benefits can provide a critical source of income for those who were injured or became ill due to their military service. However, many veterans pursuing VA disability benefits are concerned about how that income will impact other areas of their financial lives. For example, are veterans disability benefits taxable income? Will they disqualify the veteran from other types of benefits? Below is some of the important information you need to understand your veteran disability benefits more clearly.

Table of Contents

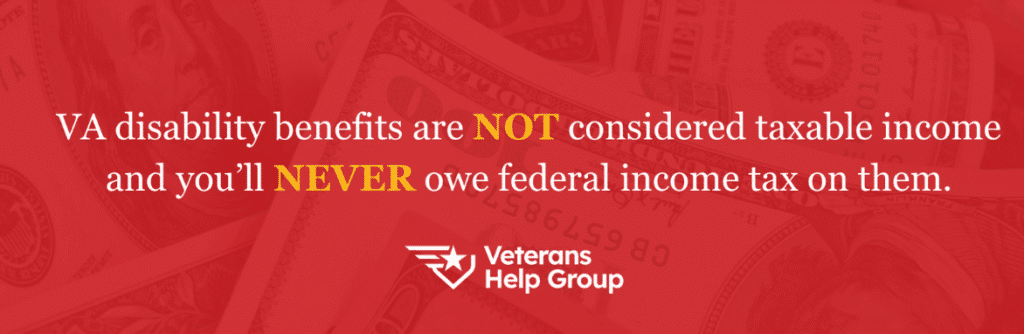

VA Disability Benefits are Not Taxable Income

Federal tax treatment of VA disability benefits is simple: the Internal Revenue Service (IRS) does not consider veterans disability benefits taxable income.

That includes not just monthly disability payments, but other veterans benefits, such as from GI Bill programs and training allowances administered by the VA. Also tax-exempt are VA grants aimed at making homes and/or vehicles accessible to veterans with disabilities.

These benefits also aren’t considered earned income to qualify for the federal Earned Income Tax Credit (EIC). However, a veteran who receives disability benefits and also has earned income may qualify for EIC.

Some Other Types of Disability Benefits May Be Taxable

Some veterans with disabilities receive benefits from sources other than the VA. You should be aware that the information in this post relates specifically to benefits administered by the VA.

If you receive SSDI, your disability income may or may not be taxable depending on the total amount of income you and your spouse receive.

Private disability insurance payments or employer-based disability pensions may also be taxable.

Reporting Disability Income

Since VA disability income is non-taxable, it generally doesn’t have to be reported. If disability benefits are your only income, you likely won’t have to file an income tax return at all. If you have other taxable income, you will still have to file as usual. And, if your spouse has income, you may want to file jointly with them, which may lower the amount of income tax due. However, you generally won’t need to report your veterans disability income and you’ll never pay income tax on it. The best course of action is to consult with an accountant or tax preparer to ensure you are following all of the IRS’s filing rules.

Veterans Disability Benefits May Be Considered Income for Purposes of Other Benefits

Whether and when veterans disability benefits may be considered income for purposes of determining other benefits is a bit more complicated than taxability. For example, if a veteran with a disability is eligible for Social Security disability (SSDI), that eligibility is not affected by VA disability payments. Only earned income is considered when determining SSDI eligibility.

On the other hand, Supplemental Security Income (SSI)–also administered by the SSA–is need-based. That means all income is considered and a veteran whose income exceeds the threshold will be denied, or the amount they are eligible to receive will be reduced, even if all of their income is from disability benefits.

If you have questions about VA disability benefits or have been denied benefits, Veterans Help Group is here for you. Contact us or call (855) 855-8992 to learn more about how we can help.

Unsure if you may be eligible for benefits? Try out our VA Veterans Disability calculator HERE.

VA Disability and Income FAQs

Understanding how VA disability benefits impact your taxes, finances, and eligibility for other programs can get confusing. To help make things clearer, here are answers to some of the most common questions veterans have about how their disability compensation is treated when it comes to income, taxes, and other benefits.

- Do I need to report my VA disability benefits on my tax return?

No. VA disability compensation is not considered taxable income and generally does not need to be reported on your tax return. If disability benefits are your only source of income, you likely won’t have to file a return at all. If you have other income, you’ll still file as usual, but you won’t include VA disability payments.

- Will my VA disability payments affect my eligibility for Social Security benefits?

It depends on the program. VA disability benefits do not impact eligibility for Social Security Disability Insurance (SSDI) since SSDI is based on work history, not income. However, they can affect Supplemental Security Income (SSI), which is needs-based and considers all sources of income.

- Can I still qualify for the Earned Income Tax Credit (EIC) if I receive VA disability?

VA disability payments do not count as “earned income” for the EIC. However, if you have additional earned income such as wages from a job, you may still qualify for the credit.

- Are other types of disability benefits taxable?

Some are. For example, Social Security Disability Insurance (SSDI) may be taxable depending on your total household income, and private disability insurance or employer-provided disability pensions are often taxable. It’s best to consult a tax professional about your specific situation.

- Will VA disability income count against me for other need-based programs?

Yes, it might. Programs like Medicaid, housing assistance, or SSI consider all income when determining eligibility. Even though VA disability benefits aren’t taxable, they may still count toward income limits for these programs.

READ MORE ABOUT THIS:

DIC Rates for 2026

DIC Rates for 2026 Dependency and Indemnity Compensation (DIC) can be a lifeline for surviving...

VA Disability Payment Schedule for 2025 (UPDATED FOR 2026)

VA Disability Payment Schedule for 2025 (UPDATED FOR 2026) VA disability compensation provides...

Do You Qualify for Special Monthly Compensation (SMC)? How Disabled Veterans Can Get Extra VA Pay Beyond 100%

Do You Qualify for Special Monthly Compensation (SMC)? How Disabled Veterans Can Get Extra VA Pay...